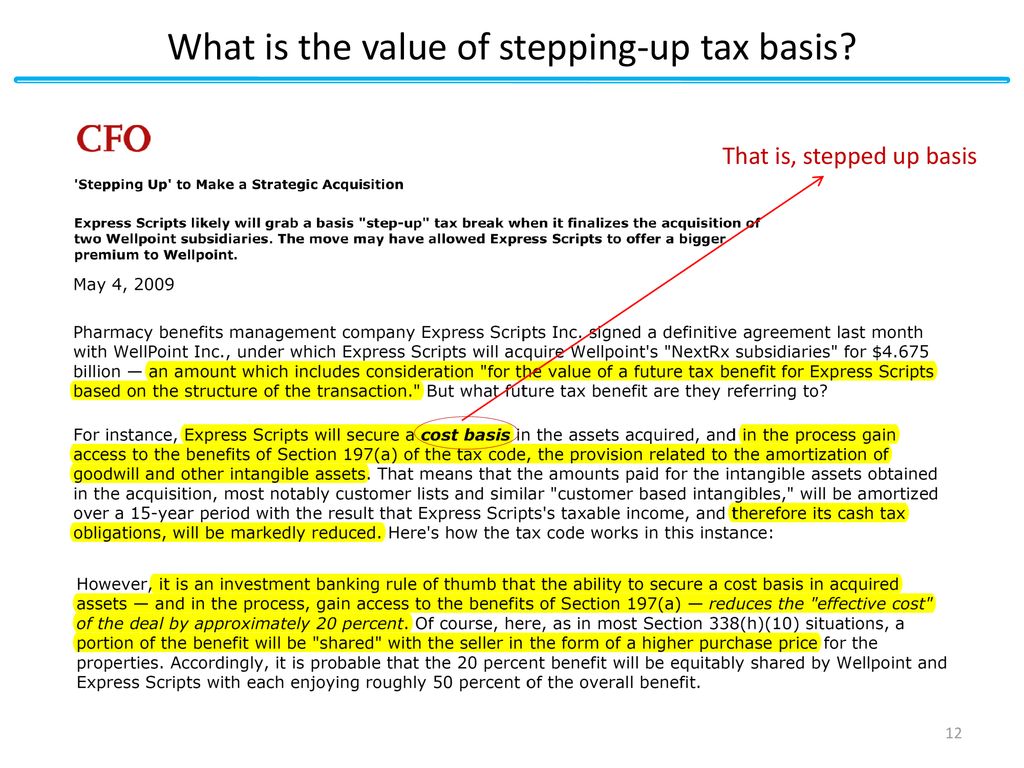

Tax-Free Rollovers in Private M&A Transactions: LLC Asset vs. Stock Drop-Down (with Examples) | Williams Mullen - JDSupra

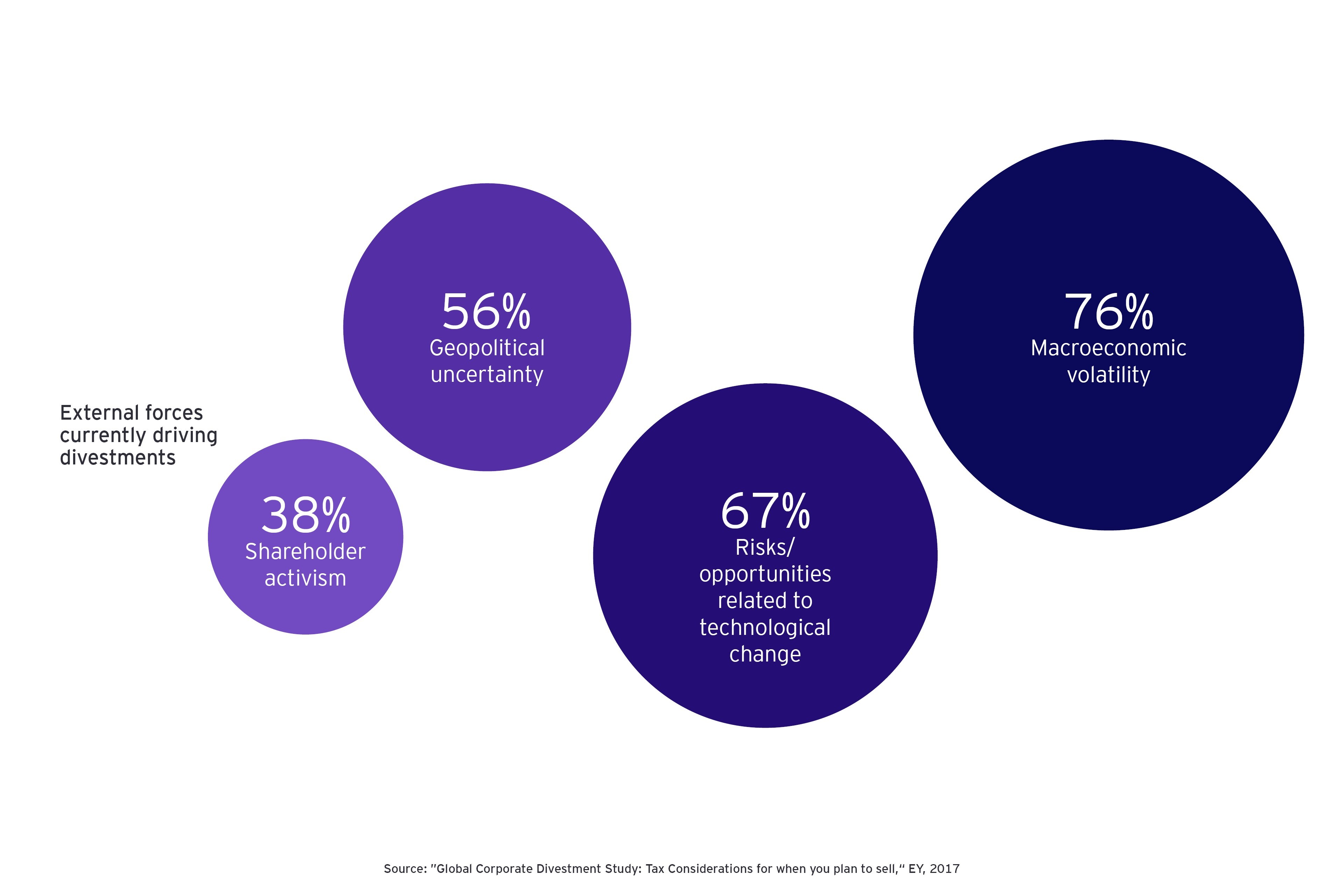

Over half of CEOs to step-up investment and M&A in 2022, but headwinds remain - The Malta Independent

Tax-Free Rollovers in Private M&A Transactions: LLC Asset vs. Stock Drop-Down (with Examples) | Williams Mullen - JDSupra

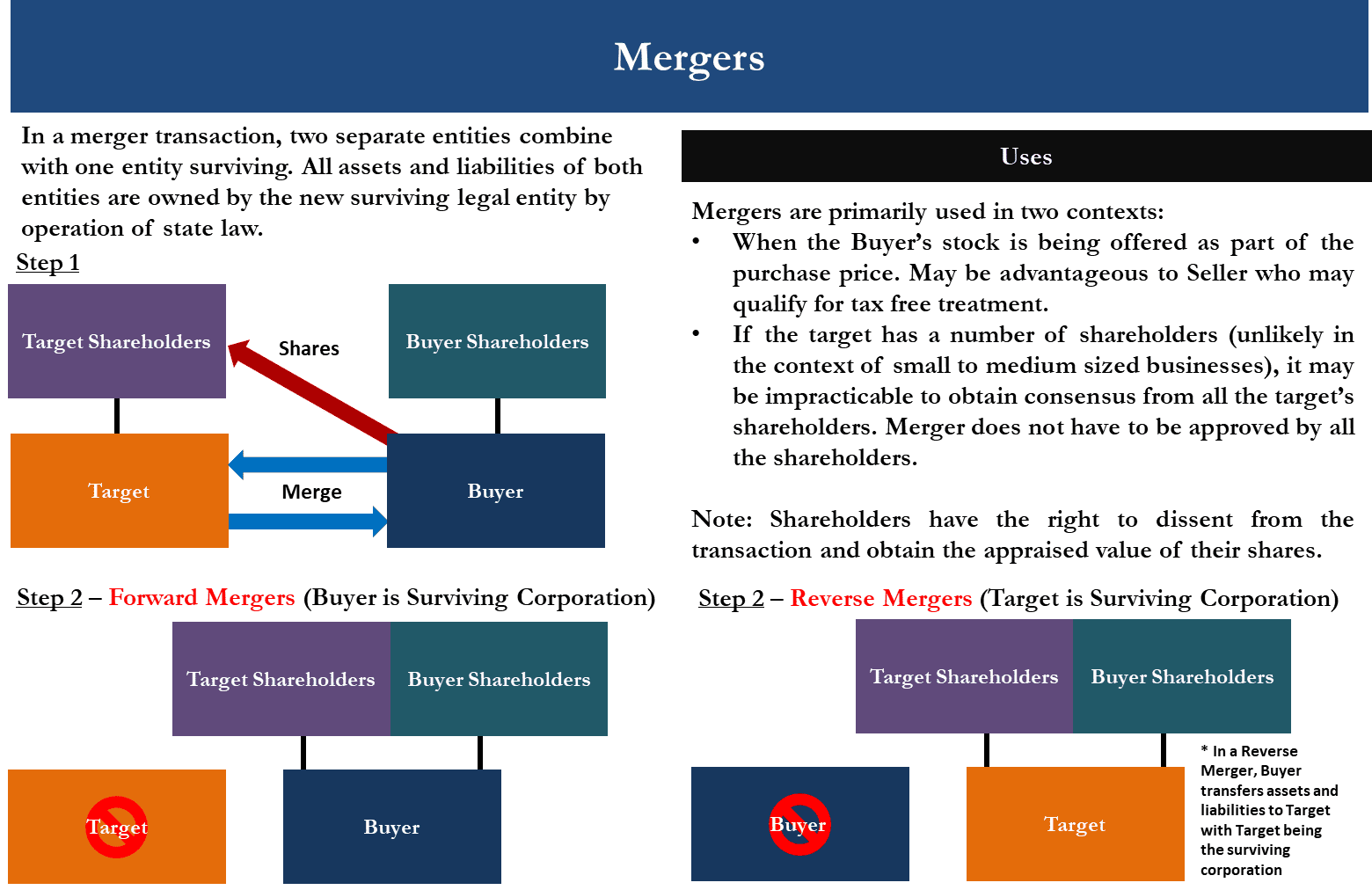

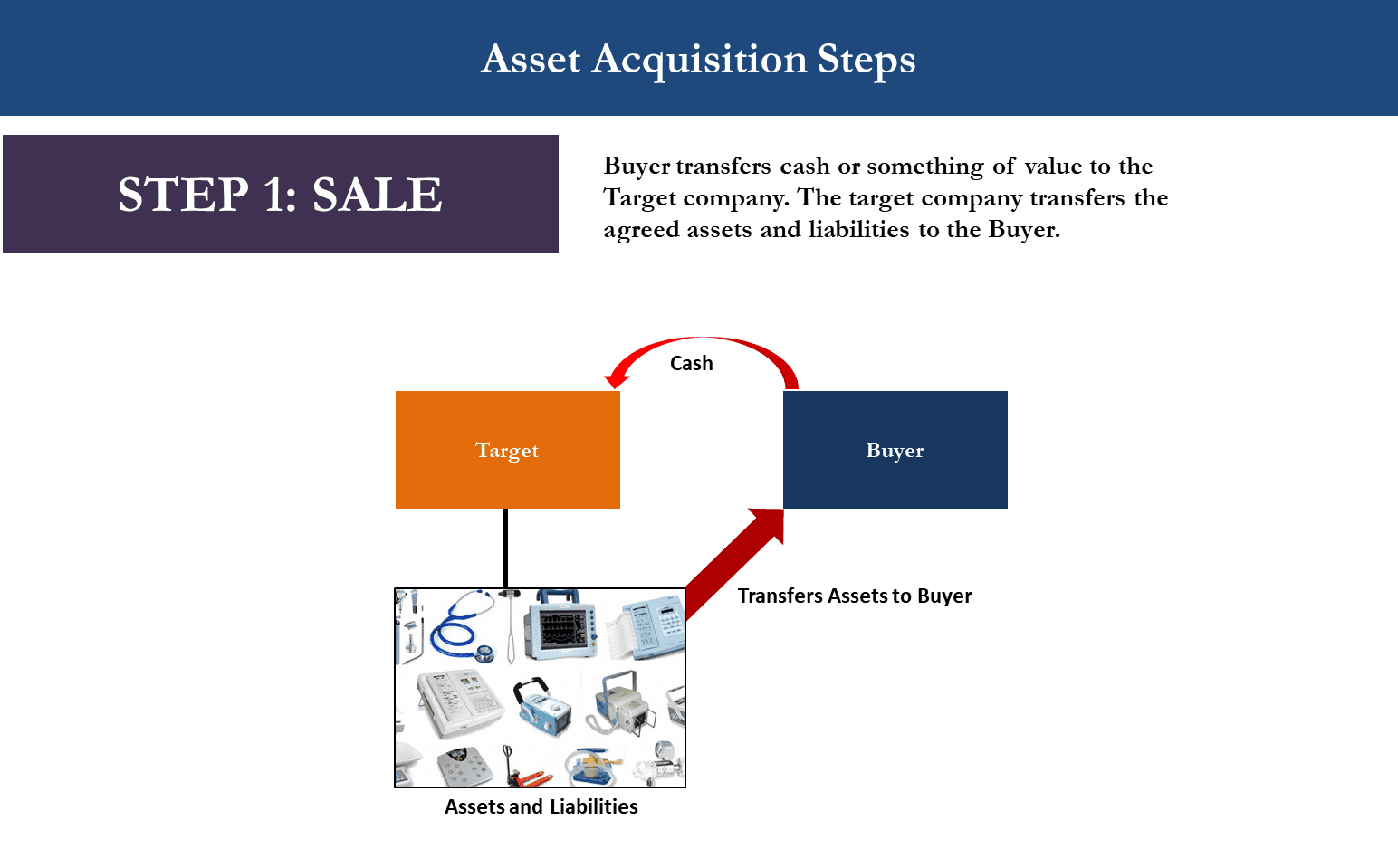

Basic Structures in Mergers and Acquisitions (M&A): Different Ways to Acquire a Small Business Genesis Law Firm